200000 mortgage cost

More generally bonds which are secured by the pledge of specific assets are called mortgage bonds. So how much does it cost to build a house.

250k Mortgage Mortgage On 250k Bundle

Rates correct as of August 2022.

. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. This is a wide price range. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

So for a 250000 loan mortgage insurance would cost around 1250-3750 annually or 100-315 per month. Census Bureau puts the sales price of a new home higher at an. But if you charge enough rent to cover your mortgage payment youll get the rest covered by your tenant plus any price appreciation.

Individual premiums for disabiity insurance will vary based on your policy benefits and factors. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. According to HomeAdvisor the national average cost to build a new home in 2022 is 283900The US.

Monthly payments on a 200000 mortgage. 120 10 years in 43837. In five years the home has appreciated 43000 and the final PMI cost is.

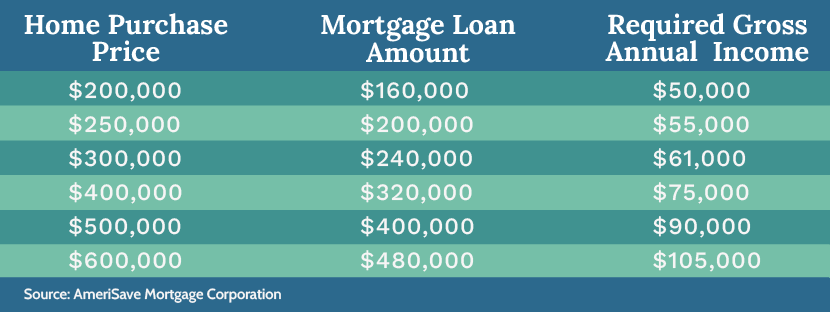

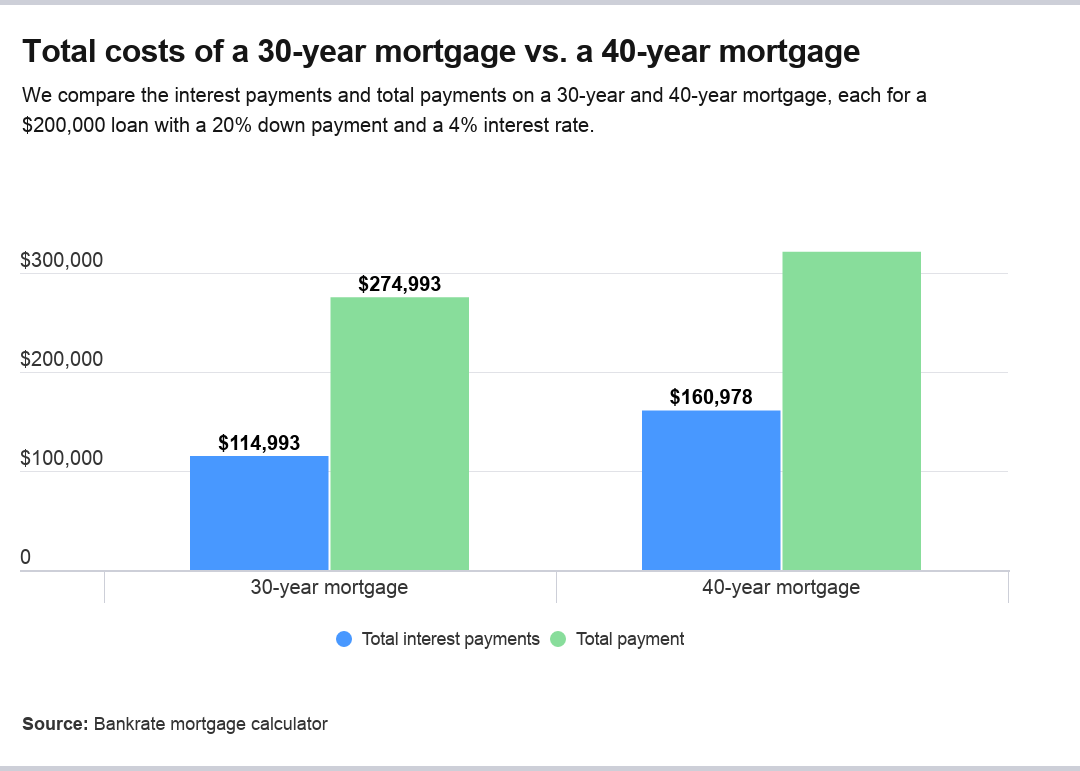

Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 718 monthly payment. Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. The final price tag typically depends on any structural or mechanical repairs square footage underlying issues location and materials used.

See the table below for an example of amortization on a 200000 mortgage. Such as the rate for Treasury securities or the Cost of Funds Index. Amna Shamim contributed research and writing to the most recent version of this story.

On 200000 property pay 7030. 60 5 years in 36443. Forbearance of residential mortgage loan payments for multifamily properties with federally backed loans.

Mortgage broker fees Brokers can help borrowers find a better rate and terms but their services must be paid for when the loan. The mortgage insurance guarantees that you will receive expected loan advances. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Whether youre on the high or low. You may be surprised to see how much you can save. For example if you take out a mortgage for 100000 one point will cost you 1000.

CARES Act for the cost of guaranteed loans as authorized under paragraph 36 of section 7a of the Small Business Act 15 USC. So one point on a 300000 mortgage would cost 3000 upfront. Latest breaking news including politics crime and celebrity.

Your fees for any discount points will appear on your Loan Estimate under Origination Charges. A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. Comparison of Five 180000 Mortgage Loans 200000 home with a 20000 down payment Traditional fixed-rate mortgage.

Mortgage rates valid as of 31 Aug 2022 0919 am. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. If youre refinancing a 200000 mortgage loan for example you could expect to pay between 4000 and 10000 in closing costs.

USDA recently issued Expenditures on Children by Families 2015. 1317957 132 rounded to the nearest whole number 132 months to reach your break-even point on your investment. In certain scenarios it could be less costly to build than to buy.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. To work out the annual cost the fee has been spread into the cost over the length of the deal 2yrs or 5yrs. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

To purchase 2 points this would cost 4000. Here are specific closing costs included in each category along with the typical cost for each one. You use the 400000 to pay off the 200000 loan and.

Find stories updates and expert opinion. 2 675000000 under the heading Small. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Unlike other fees discount points arent mandatory. To estimate your break-even point more easily you can use the above calculator. For example a 20 down payment on a 200000 house is 40000.

Note that your monthly mortgage payments. 636a as added by section 1102a of this Act. For a 200000 loan a point costs 2000.

30-year term 67 interest rate. A long-term disability insurance policy costs 1 to3 of your salary and is the most cost-effective form of income protection you can buy. On a 200000 mortgage thats 6000.

Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage. The table is based on a typical 25 year mortgage term. In the example each point would cost 2000 because 1 of 200000 is equal to 2000.

HECM origination fees are capped at 6000. Home Loan Amortization Table Payment Month Principal Interest Total Payment. This report is also known as The Cost of Raising a Child USDA has been tracking the cost of raising a child since 1960 and this analysis examines expenses by age of child household income budgetary component and region of the country.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The average cost to completely renovate a house is 15000 200000 4Depending on the characteristics of the build the price can change drastically. A lender can charge the greater of 2500 or 2 of the first 200000 of your homes value plus 1 of the amount over 200000.

Mortgage Insurance Premium You will incur a cost for FHA mortgage insurance. Are often a more efficient and lower-cost source of financing in comparison with other bank and capital markets financing alternatives. Argue that debt issued by the Federal National Mortgage Association and.

Amortizing loan Monthly payments are large enough to pay the interest and reduce the principal on your mortgage. Based on the most recent data from the. The male earning 95000 per year and retiring in 2045 is estimated to lose over 200000 by participating in the Social Security system.

Estimate the cost of 30 year fixed and 15 year fixed mortgages. On 200000 property pay 11040. 65897 66.

The total cost of the Social Security program for the year 2019 was 1059 trillion or about 5 percent of US. A 20 down payment typically allows you to avoid private mortgage insurance PMI. 320 35 fee.

On 200000 property pay 11720. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. Sample premiums are broad guidelines based on industry data in 2022.

How Much A 200 000 Mortgage Will Cost You

What A 200 000 Mortgage Will Cost You Credit Com

How Much Would I Pay On A 200 000 Mortgage Finder Canada

5 Year Fixed Mortgage Rates And Loan Programs

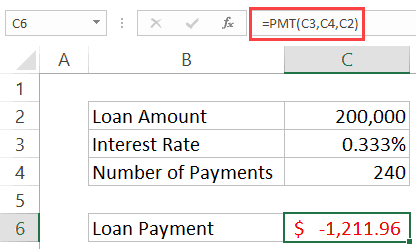

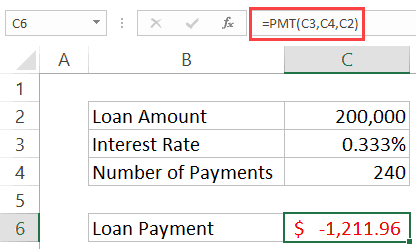

Excel Pmt Function To Calculate Loan Payment Amount

How Much Would I Pay On A 200 000 Mortgage From 1 24

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How Much House Can I Afford Bhhs Fox Roach

Income Requirements Calculator For A Home Mortgage Amerisave

How Much Would My Payment Be On A 200 000 Mortgage Finder Com

How Much A 200 000 Mortgage Will Cost You

Discount Points Calculator How To Calculate Mortgage Points

Article Real Estate Center

How Much A 350 000 Mortgage Will Cost You Credible

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How Much A 1 000 000 Mortgage Will Cost You Credible

30 Year Mortgage Rates Calculator Clearance 57 Off Www Ingeniovirtual Com